Elections & market reactions

What do presidential elections mean for your portfolio?

Should you change your investing strategy based on who wins?

Elections bring a lot of noise, and I wanted to dispel some market myths around this election.

Myth #1: Elections usually bring big market swings.

You would think elections cause major market shifts (given all the politicking and intense emotions).

However, history shows that elections historically don't influence market performance as much as the economy does.

Growth, inflation, corporate profits, and other business and economic trends usually have a stronger effect on the stock market.1

The president and Congress impact markets through the laws they pass and decisions they make, which are more powerful influences than elections alone.

Myth #2: Markets perform better with one party in power.

You might have heard that markets perform better under Democrats or Republicans.

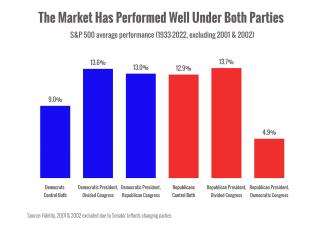

History shows that markets have performed well under both parties.2

Interestingly, stocks have historically performed best under a “divided” government when neither party controls both Congress and the White House.

Myth #3: The “election cycle" means I should change my investment strategy.

You might have heard of the so-called “election cycle,” where markets are supposed to follow a consistent pattern every four years.

The chart shows S&P 500 performance since 1950.2

You can see that there isn't a consistent pattern to performance, with both negative and positive years over time.

However, on average, markets have been generally positive each of the four years.

Emotions are high, and changing your strategy ahead of a contested election can be tempting, but it's not a good idea.

Truth: Elections are just one factor affecting markets over the next few weeks and months.

We can expect volatility around the election, but traders are also analyzing a lot of other factors:

- The Federal Reserve's path to rate cuts

- Inflation and economic data

- Geopolitics and conflicts overseas

And much more.

Truth: Tax laws and regulatory changes may impact markets in 2024 and 2025.

With many provisions of the Tax Cut & Jobs Act (TCJA) scheduled to expire at the end of 2025, tax policies are something we’re monitoring closely.3

International trade issues may also influence markets if tariffs increase or supply chain problems continue.

Bottom line: Elections bring uncertainty, so we're watching carefully.

We don’t know how the election results will play out over the coming months and years.

So, we’re staying flexible, watching the trends, and making careful shifts where needed.

Do you have any questions about how the election could impact your portfolio? Feel free to reach out.

Sources

2. https://www.fidelity.com/learning-center/trading-investing/election-market-impact

3. https://tax.thomsonreuters.com/blog/what-to-know-about-tcja-expiration/

Chart sources:

https://www.fidelity.com/learning-center/trading-investing/election-market-impact

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.

The S&P 500 is an unmanaged composite index considered to be representative of the U.S. stock market in general. Past performance is no guarantee of future results. Indices are unmanaged, do not incur fees, costs, and expenses, and cannot be invested into directly. For illustrative purposes only. Past performance is no guarantee of future results.

Content prepared by Snappy Kraken.